Part 1 – Introducing jumps to GBM

See the R code to generate stochastic volatility simulations

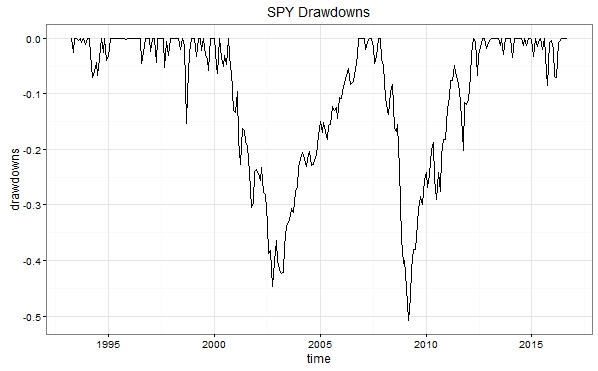

This experiment addresses the parenthetical part of the title, stochastic volatility. As previously discussed, GBM is not practical for equity simulations mainly because it doesn’t properly capture drawdowns. Introducing jumps, or downward shocks into the simulation is one way of addressing this limitation, another way is to let volatility become another random variable in our simulation. The second approach is appealing because volatility empirically behaves like a random variable, see for example the volatility of the popular S&P 500 ETF, SPY, plotted over time.

The chart above illustrates the stochastic nature of equity volatility. When volatility drifts higher in our simulation we should be able to generate larger (and more realistic) drawdowns.

GBM with stochastic volatility requires additional parameters: we need to consider the mean reversion tendencies of volatility, the volatility of volatility, and the correlation between the path of equity and the path of equity volatility. The additional complexity is the main drawback of stochastic volatility. However, I propose the volatility of equity does behave like a random variable with mean-reversion tendencies that requires additional complexity beyond simple GBM.

Let’s consider an equity simulation over one year. We’ll take 252 steps along this year (one for each trading day) and set up our mean reversion parameters to allow volatility to drift for awhile but come back to an average level. Furthermore we’ll suppose the paths of price and volatility are indeed positively related but not perfectly correlated, say at a level of 0.6. You can see the link to the code at the top of this article for specifics.

Does adding stochastic volatility improve our simulation’s ability to capture equity drawdowns? Let’s take a look at the 5th percentiles of 1000 paths (VaR 95%).

The stochastic vol paths in red have lower values than a comparison simulation with constant vol in black. There are of course other ways to simulate equity including nonparametric methods, but if you’re using GBM strongly consider using stochastic volatility or introducing jumps (see prior post) to better capture the downside risk of equity.

[…] via If you’re going to simulate equity with GBM, jump around (or use stochastic vol) part 2 — Paperb… […]

LikeLike